17 year-old David Otegbola on the economic future of young people

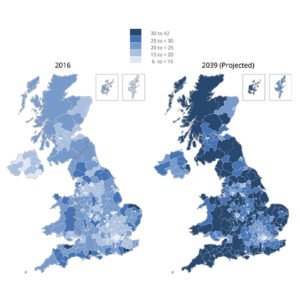

The proportion of the population aged 65 years and over, 2016 and 2039, United Kingdom.

October 27, 2023

How will the UK’s ageing population affect our wallets?

The 2021 British Census confirmed economists’ prediction of an increase of older population demographics. Since 2011, the population of the United Kingdom aged 65 and over has risen by 2.2%, according to the Office for National Statistics.

But why is the population of the UK, and many other developed economies, becoming older?

The main reason is that families in Britain have children less often. Currently, the fertility rate stands at 1.5 children per woman. In 2011, it was 1.91.

The decline in fertility rates stems from the shifts in household roles, which has enabled women to be independent of men economically. Another factor is the increasing economic pressures (which the ongoing cost-of-living crisis is only expected to exacerbate), resulting in young couples deciding not to start or grow their families because of financial stability concerns.

An ageing population will have an effect on the UK’s financial and labour markets and will influence future decisions and policies. The Office for Budget Responsibility lists the ageing population as the main reason for total public spending (excluding interest payments) expected to increase from 33.6% to 37.8% of Gross Domestic Product (GDP) between 2019/20 and 2064/65.

Labour markets

The ageing population will likely result in the decline of the UK’s active labour force. This will put greater pressure on the future working population – including today’s teenagers – to deliver the funds necessary for the public sector.

With fewer people working, GDP is likely to grow at a lower rate, and both economic growth and the productive potential of the economy will be hindered.

Additionally, greater tax burdens will have to be placed on the working population as there will be higher financial requirements for pensions and health care, which have to be provided by the UK government.

More problems arise with the workforce’s productivity. A study in 2020 found a “1% increase in the proportion of the population aged 60 or over reduces growth in labour productivity (GDP per worker) by 0.18%.”

With companies bound to lose their experienced workers as they reach retirement age, businesses will have to invest more in training to upskill younger workers.

This may contribute to a rise in inflation because of additional production costs for companies, resulting in a cost-push to customers. In the short run, companies will face reduced productivity due to the extended time scale of education for workers training to gain the needed qualifications.

Reports also show that an insufficient number of places in retirement housing results in older people using properties which are too large for their needs, a phenomenon negatively impacting not only their finances but also the younger part of the population, which has limited access to accommodation.

This will further worsen the housing crisis, especially in cities. For example, in London 14% of families are homeless while available properties for private rent dropped by 41% since the COVID-19 pandemic.

Despite all this, labour shortages could still benefit young people as there will be less job competition when they enter the market.

What can the UK learn from Japan’s stagflation?

Learn more:

‘Changing demographics to have greater impact than war in Ukraine and Covid crisis’

Andrew Bailey, Governor of the Bank of England, has also recently sounded off on what the UK faces with an ageing population, naming it ‘one of the two biggest problems facing the UK.’

He recommended that central banks should prioritise efforts in mitigating shorter-term shocks – such as the economic fallout of Russia’s attack on Ukraine – he reaffirmed that the issue of an ageing population should not be ignored.

The main concern is that with an ageing population, the aggregate demand will fall. The disposable income (the money left after taxation and necessary spending) decreases when the taxation rate increases and this will be needed to pay for policies resulting from an ageing population.

This can lead to stagflation1 and possibly deflation. An example of a country in this situation is Japan, the country which has the oldest population in the world, with one in ten people being aged 80 or older.

The Bank of Japan has been wrestling with disinflation for around 20 years. Because of the nation’s reluctance to accept immigrant workers, and with no signs that the fertility rate is going to improve, Japan still focuses on employing looser fiscal policy, such as using tools like negative interest rates, with very limited success.

How does numerous rich pensioners affect the economy?

In the 20th century, there were established patterns of how spending changed with age. Younger people consumed more as their careers grew, and they needed new commodities because of frequent changes in their lives. Mid-life, customers had stable, structured expenses, which included repaying debts and saving for retirement. With retirement, income dropped, and in many instances, assets amassed were used to make ends meet.

The consumption by the older population has now soared – The Guardian reported that spending by those aged 65 and over increased by 75% between 2001 to 2018. Affluent retirees may force interest rate hikes over time because of the inflationary pressure generated by older customers’ spending power.

The high number of people saving for retirement supports the financial markets while increased spending in a late stage of life has the opposite effect. Older people are also known to be risk-averse and prefer safer assets, which can have implications for financial markets – if there is an increased demand for safe assets such as government bonds, it will cause their price to rise, which in turn will likely cause their interest rate to fall. This will result in fewer returns on investment.

Effectively, lower returns from investment will limit the ability of younger people to save for their retirement compared to previous generations, likely forcing Generation Z to stay in the workforce for longer.

However, the impact of this process will be limited with an ageing population because the proportion of people in the workforce will be lower, which could counterbalance the increased demand for safe assets.

Potential governmental solutions?

French President Emmanuel Macron recently raised the state pension age from 62 to 64, a decision for which he faced widespread backlash. If governments cannot make reforms like this, it will strain the public finances as more and more funding will be required for pensions.

However, decision-makers should also keep in mind that if they raise the pension age, they still need support schemes for those who find themselves out of work close to retirement and are not able to support and aren’t able to support themselves. Therefore, some believe it might be better not to raise the retirement age, but to promote remaining professionally active beyond retirement age instead.

The UK government should also consider relaxing immigration laws by offering visas to young people to counteract the ageing population and increase the number of working-age individuals.

However, this decision could prove unpopular with the electorate, as numerous citizens feel that immigration ‘undermines British cultural life’, which the Brexit referendum illustrated.

Promoting fertility is another way for the UK government. Tax breaks, increasing the provision of childcare services and encouragement to have more children would help reversing the trend of declining fertility rates over time.

However, this solution can be a sustainable and low-risk attempt to shift the country’s ageing population in which the youth will be at the core of its workforce.